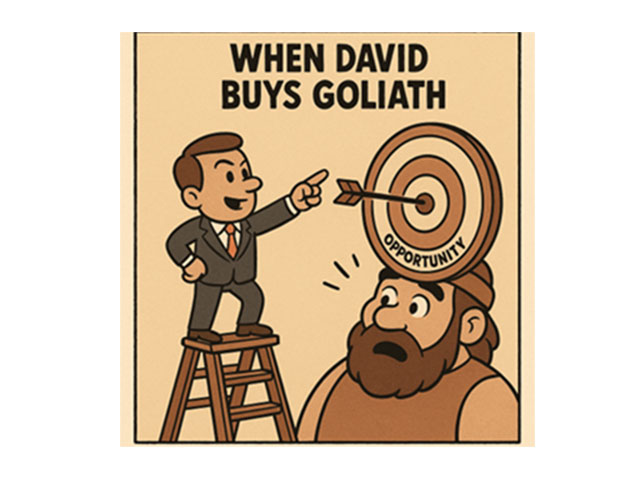

When David Buys Goliath: Why Bold Entrepreneurs Should Think Bigger

In business, the giants are usually the ones making headlines for acquisitions. Yet history shows that sometimes it is the smaller, more agile players who rewrite the rules by acquiring companies many times their size. These “David vs. Goliath” moments have shaped entire industries, from Vodafone’s audacious takeover of Mannesmann at the turn of the millennium to InBev’s acquisition of Anheuser-Busch, which created the world’s largest brewer.

The recent news of Perplexity AI’s $34.5 billion bid for Google’s Chrome browser is the latest reminder that size alone does not determine who leads the game. Perplexity, valued at a fraction of its target, put forward a vision that captured global attention. The move raised a provocative question: what would it take for a smaller company to acquire a much larger one, and why should entrepreneurs even consider it?

The answer lies in the transformative power of bold moves. For ambitious companies, such acquisitions are not reckless gambles but carefully calculated strategies. Buying a larger rival can instantly create scale, open access to new customers and technologies, and reshape the competitive landscape. It can prevent critical platforms from falling into the hands of competitors and, when managed well, can position the acquirer as an industry leader overnight.