At Kylla, we are often asked whether the success of a company depends more on the strength of the founder’s idea or the way the business is built. Our answer is always the same: ideas can spark a business, but systems are what make it endure.

Many founders fall into what Michael Gerber, in his classic book The E-Myth Revisited, calls the “fatal assumption.” They believe that because they understand the technical work of their craft, they also understand how to run a business that does that work. A gifted baker imagines their pies will sell themselves, a talented engineer thinks their code will be enough to build a company. But the reality is different. Without systems to ensure consistency, efficiency, and growth, the founder ends up working longer and harder than ever, chained to a business that cannot function without them.

I know from personal experience how true this is. Before joining Kylla, I ran restaurants and a delicatessen in Harpenden, England. Without systems, the kitchen and the restaurant would have been total chaos, and we could never have grown to the level we did. Systems brought structure, clarity, and the ability to deliver a consistent, high-quality experience to every customer, every day.

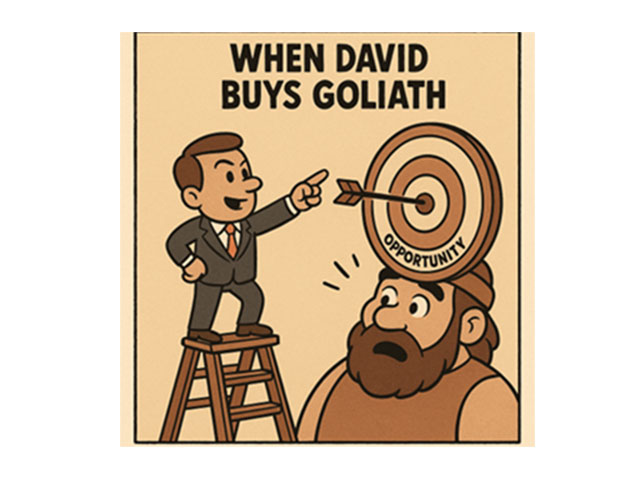

The movie The Founder illustrates this point beautifully. The McDonald brothers had perfected a highly efficient kitchen process, but it was Ray Kroc who realised that the genius was not in the hamburger itself, but in the system that produced it. By designing a model that could be replicated anywhere, with the same results every time, he turned a local diner into a global enterprise. Customers did not flock to McDonald’s because it had the most innovative menu, but because they knew exactly what to expect. The system created trust, and trust created scale.